Artificial intelligence is everywhere in retail conversations today. Leaders are investing in new platforms that promise smarter search, more relevant recommendations, and personalized shopping experiences at scale. Yet, despite the optimism, many of these initiatives fall flat once they are deployed. The reason is not that the technology itself is flawed, but that the product data feeding these systems is unfit for purpose.

The AI Multiplier Effect

AI does not operate in a vacuum; it relies on the quality of the information it is given. When that information is incomplete, inconsistent, or inaccurate, the results reflect those flaws. The principle of “garbage in, garbage out” has never been more visible than in retail AI, where the strength of the data foundation determines whether an investment produces ROI or embarrassment.

What “Garbage” Data Looks Like in Retail

It's easy for retailers to assume that their product catalogs are ready for AI pilots, but even mature retailers discover gaps once the data is examined closely. Catalogs that seem acceptable for manual merchandising quickly reveal flaws when AI systems try to interpret them. These gaps undermine the very use cases AI is meant to improve, from product discovery to recommendations.

Common examples include:

- Incomplete Attributes - Missing details like size, material, or compatibility prevent search and recommendation engines from working as intended.

- Inconsistent Taxonomy - When one system labels a product as “outerwear” while another calls it “jackets,” algorithms cannot make accurate connections.

- Inaccurate Information - Conflicting attribute values erode both accuracy and customer trust.

- Unstructured Data - When feeds lack schema markup, AI tools cannot parse product details for AEO, personalization, or marketplace compliance.

What might appear as small gaps at the SKU level compounds quickly into systemic problems that AI cannot resolve.

Real-World Examples of AI Failure in Retail

The consequences of poor product data come into sharp focus when AI pilots go live. These failures are often public, frustrating customers and exposing weaknesses in a retailer’s digital infrastructure. We outline 3 scenarious to consider below.

- Search Gone Wrong: A shopper asks for “women’s waterproof hiking boots under $150,” only to be shown irrelevant sneakers and raincoats. The engine had no consistent attributes to filter results properly.

- Chatbots That Confuse: Grocery customers ask a voice assistant for “gluten free bread,” but receive standard loaves because dietary attributes were never included in the catalog.

- Random Recommendations: An electronics retailer launches a recommendation engine, only to discover it suggests dishwashers to headphone buyers due to mismatched taxonomy across databases.

In each case, the AI wasn't broken. It simply reflected the incomplete or inconsistent inputs it was provided.

The ROI Impact of Dirty Data

Beyond customer frustration, poor product data has direct financial consequences. Anyone evaluating AI investments must factor in not only the cost of tools and integrations, but also the losses incurred when pilots underperform.

Some of the most common impacts include:

Lower Conversions - Research from Baymard Institute shows global e-commerce conversion rates average only 2 to 3 percent. Weak product data is a primary reason many retailers never surpass this baseline.

Higher Returns - In apparel, return rates climb to nearly 30 percent when sizing attributes are inconsistent or poorly represented.

Wasted Spend - AI pilots require significant resources, and when they fail due to dirty data, sunk costs can easily run into the millions.

Lost Trust - Customers who encounter irrelevant or inaccurate results are less likely to give the brand another chance.

For senior decision makers, these are not small operational issues. They represent strategic risks that can derail digital transformation plans.

How to Build Data Hygiene as a Business Priority

Improving product data quality is not simply an IT project, it is a business priority that must be championed at the executive level. The path to readiness requires a deliberate framework that combines assessment, standardization, and governance.

Below are a few practical steps to take towards erecting a better prodcut data foundation.

- Conduct a Product Data Audit: Evaluate how many SKUs have complete attributes, schema compliance, and accurate imagery.

- Establish Standards: Define consistent taxonomy, attribute values, and structured data requirements across the organization.

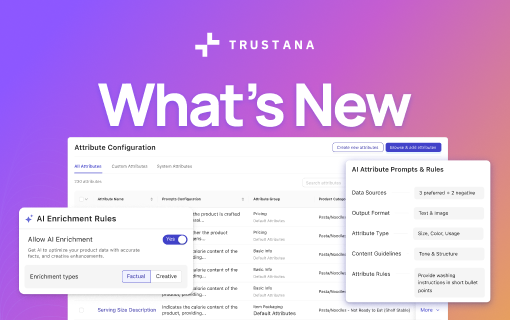

- Invest in Enrichment and Cleansing: Use automation to fill gaps and normalize values, supported by human quality control.

- Build Governance: Assign clear ownership of data quality, implement audit cadences, and establish validation processes.

- Tie AI Investment to Readiness Metrics: No pilot should proceed until minimum thresholds for completeness, accuracy, and schema alignment are met.

By embedding these steps into strategic planning, leaders ensure that AI pilots are set up to succeed rather than fail.

AI Success Starts with Data Discipline

The lesson for retailers is simple but critical. Artificial intelligence does not rescue poor product data, it exposes it. If catalogs are missing details, inconsistent across channels, or riddled with errors, AI initiatives will magnify the problem and damage customer trust.

By treating product data hygiene as a foundational discipline, retailers can ensure that every AI project rests on a strong footing. The investment in enrichment and governance is not just about operational efficiency, it is about protecting ROI and unlocking competitive advantage. Retail AI succeeds when product data is complete, accurate, and structured for the systems that rely on it.

For a full framework, see the AI-Readiness for Retail Guide

Why Retail AI Fails Without Clean Data FAQ

Why do most retail AI pilots fail?

Because product catalogs lack enriched attributes, structured schema, and consistent taxonomy. AI cannot compensate for missing or messy data.

What business outcomes are most impacted by poor product data?

Executives see lower PDP conversions, higher return rates, wasted investment in pilots, and long-term damage to brand trust.

How can leaders measure AI readiness?

Track metrics such as the percentage of SKUs with complete attributes, schema compliance rates, and the frequency of data audit scores.

What ROI can retailers expect from fixing data quality before AI pilots?

Industry benchmarks show PDP conversions improving by 20 to 40 percent and return rates decreasing when catalogs are enriched and standardized.

How quickly can AI readiness improvements be realized?

Meaningful improvements can be achieved in three to six months with automation and governance, while full maturity typically takes a year.